You have to think carefully about whether to use cash or borrow it. I’d like to inform you about low-income loans

If you suddenly need cash or the interest rate on loan products is high, it is not difficult to replace them with other interest rates if you are aware of the details of the loan-related information. However, I would like to take this opportunity to explain basic loan-related information as there are quite a few people who are reluctant to look into it in detail under the pretext of complexity and many people seem to find it difficult to repay. In addition, if you understand it in detail, you can simply go beyond urgent money and withdraw it to sources such as investment funds, so if you have a plan, I recommend that you take a look at it until the end.

I will teach you to understand the core content easily. For those looking for low-income loans

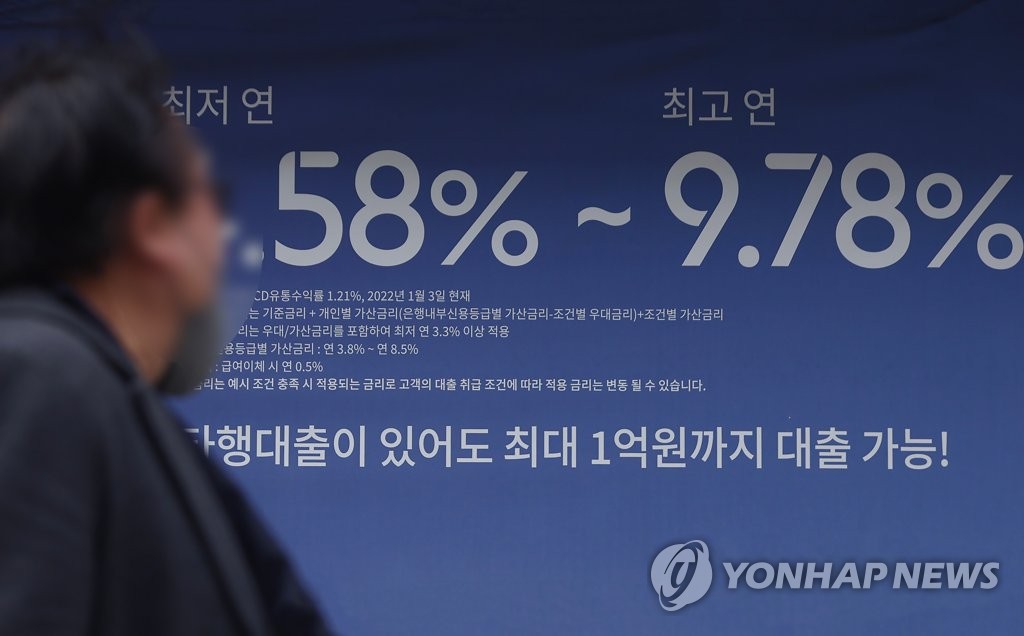

The difference between the first financial sector, which includes general banks, and the second financial sector, which includes other credit card companies and savings banks, is usually shown in interest rates, but it cannot be seen as a full profit just because interest rates are low. Commercial banks can significantly reduce their payments due to loans at 3.76% interest rates, but it is difficult to attract a lot of funds because the maximum limit is limited to 55% of their annual income. In addition, the results of the loan review are determined according to each condition, so you should first consider how to use the money and then choose the loan, then focus on dealing with the money problem that has been approaching by deciding on interest rates and maximum limits.

For those who are looking for low-income loans for ordinary people that can be used without much burden

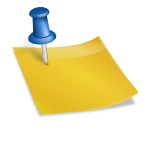

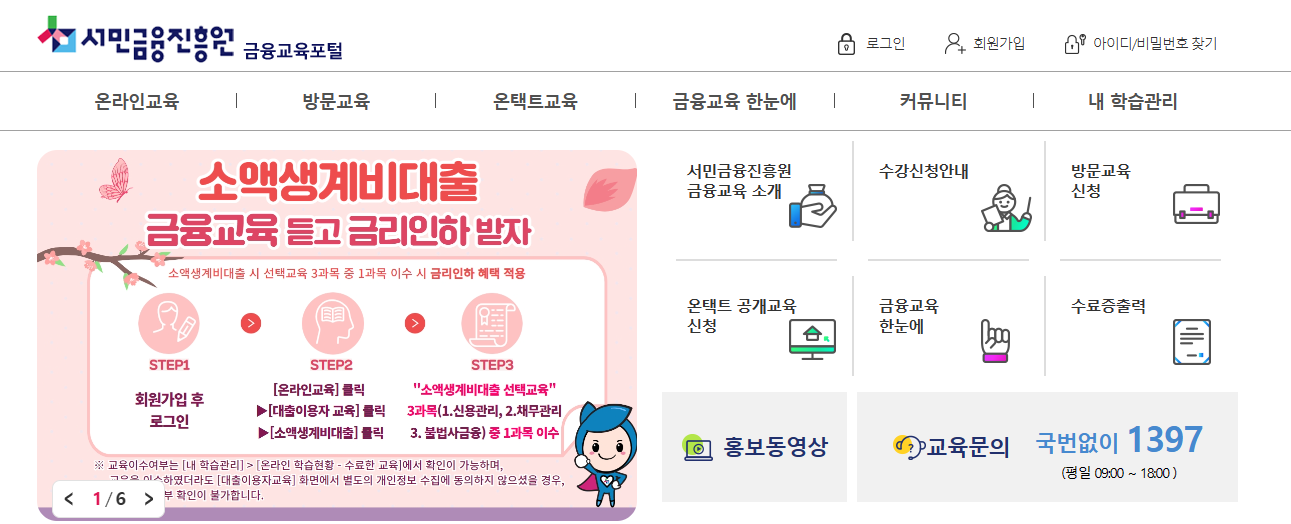

If the credit rating is worse than average or it is difficult to lend extra funds to ordinary banks due to arrears or workouts, there are many routes to use products from ordinary people supported by state institutions, so you don’t have to worry. The government does it for ordinary people who do not have many assets or have a lot of expected withdrawals and have difficulty repaying them due to the burden of interest rates, but the loan limit is about 9 million won, and the grace period and repayment period are up to 13 years. We will discuss the details of loans for the common people in more detail later.For those who were looking at loans that could further increase returns and low-income loans for investmentIn addition, as more and more people are interested in investment due to the growth of the real estate economy, it is not difficult to start DTI and LTV without funds available immediately, and the proportion of mortgage loans is increasing However, contrary to credit loans, the limit has risen according to the KB market price and even 70% of LTV can be lent, so it is dangerous if you do not check it out for sure. If you look into it in detail, it can be used at an interest rate of 2.23% because you may receive more than 7% interest rate in the method of equal repayment of principal.It’s better to search steadily and then go according to each condition. This is information about low-income loansAs more and more people are working together, when interest is focused on stocks for unearned income, using loans through rude processes can easily accumulate wealth. However, Ga, who drew dangerously without thinking about it, should choose appropriate loan products according to the purpose of use, credit loans are 3.53% cheaper, monthly repayment is about 550,000 won, and mortgage loans are 78% cheaper and can be lowered to 1.25 million won or more. We have looked into a lot of financial information and loan products so far, but if you need to prepare a lot of money, please compare them in detail and take them well.Previous image Next imagePrevious image Next imagePrevious image Next image